An Advisory Focused Firm

Contact us for Business Advisory

About Company

WHO WE RE

DBA is an Advisory focused CPA firm, adding Value to both private and public institutions.

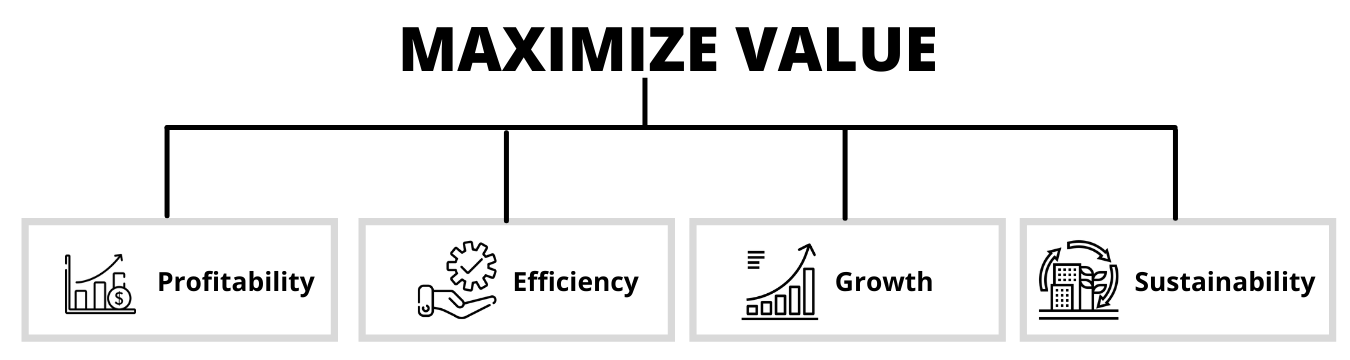

DBA helps businesses maximize Value and grow business valuation into multiple, by keeping them focused on mission-critical Performance levers of Profitability, Efficiency, Growth, and Sustainability.

Brand Essence

Our Brand Essence captures our Vision, Mission, and Core Values.

OUR VISION

To be the Designated Business Advisers of Prime Value

Why Should You Choose DBA?

Strategic Business Partners

Our testimonials

What they’re saying

I was very impresed by the kitecx service lorem ipsum is simply free text used by copy typing refreshing. Neque porro est qui dolorem ipsum.

Christine Eve

Founder & CEO

I was very impresed by the kitecx service lorem ipsum is simply free text used by copy typing refreshing. Neque porro est qui dolorem ipsum.

Kevin Smith

Customer

I was very impresed by the kitecx service lorem ipsum is simply free text used by copy typing refreshing. Neque porro est qui dolorem ipsum.

Jessica Brown

Founder & CEO

I was very impresed by the kitecx service lorem ipsum is simply free text used by copy typing refreshing. Neque porro est qui dolorem ipsum.

David Anderson

Customer

I was very impresed by the kitecx service lorem ipsum is simply free text used by copy typing refreshing. Neque porro est qui dolorem ipsum.

David Anderson

Customer

I was very impresed by the kitecx service lorem ipsum is simply free text used by copy typing refreshing. Neque porro est qui dolorem ipsum.

David Anderson

Customer

I was very impresed by the kitecx service lorem ipsum is simply free text used by copy typing refreshing. Neque porro est qui dolorem ipsum.

David Anderson

Customer

About Company

Architecture core values

Clients Satisfied

Projects Completed

news & articles

Recent blog posts

It seems like you’re running a default WordPress website. Here are a few useful links

Millard0 Comments

Donation is Hope for Poor Childrens

There are many variations of but the majority have simply free text available not suffered.

Millard0 Comments

A Place where Start New Life with Peace

There are many variations of but the majority have simply free text available not suffered.

Millard0 Comments

We can make a Difference in Lives

There are many variations of but the majority have simply free text available not suffered.

Millard0 Comments

Build School for Poor Childrens

There are many variations of but the majority have simply free text available not suffered.

Millard0 Comments

Learn How access to Clean Water

There are many variations of but the majority have simply free text available not suffered.

Our benefits

checkout kitecx goals

Interior sketch

There are many variations of passages of Lorem Ipsum available, but the majority have suffered.

3d modeling

There are many variations of passages of Lorem Ipsum available, but the majority have suffered.

Offering

Firm Focus

Capital Raising Enterprise Valuation & Fairness Opinion Mergers & Acquisitions Corporate & Financial Strategy

Adjunct Services

Board Advisory Services Outsourced CFO Services Accounting & Tax services Training

CAPITAL RAISING

Capital Needs

Greenfield Start-Up Capital Brownfield Expansion Capital Working Capital Financing Project Financing Business Acquisition Financing Asset Acquisition

Methods

Private Equity Placement Private Debt Placement Private Equity Funding Bank Borrowings Leverage Borrowing Leases

ENTERPRISE VALUATION & FAIRNESS OPINION

Engagement

Sell-Side deals Buy-Side deals Enterprise Valuation Deal Negotiations

Transaction Type

Business Acquisitions Voluntary Business Sales Distressed Business Sale Mergers & Acquisitions Strategic Investments Private Equity Investments

MERGERS & ACQUISITIONS

Engagement

Sell-side and buy-side deals Target identification Lead Financial Adviser Enterprise Valuation Financial Due Diligence Deal negotiations Deal closures Regulatory interface Integration planning Negotiating Tax settlements Stakeholders’ Management Scrutineers at Shareholders’ meetings

Transaction Type

Business Sales Business Acquisition Mergers Strategic investments Private Equity investments Leverage Acquisition Management Buy-Outs Management Buy-Ins Buy-In Management Buy-Outs Divestments Spin-Offs Asset stripping

CORPORATE & FINANCIAL STRATEGY

Corporate Renewal Establishing & managing Value drivers Business Institutionalization Transgenerational Sustainability Succession Planning Strategic Planning Market Leadership

Operational Efficiency Inorganic Growth strategies Mergers & Acquisition Strategic Partnership Backward Integration Diversification Technology Enablers

BOARD ADVISORY SERVICES

Advisory on Board structure and compositions Advisory on Board Appointments Advisory on Board effectiveness Serving as a Independent Board Director Serving as Independent Audit Committee Member Serving as Company Secretary

Advisory on Auditor appointment Head-haunting CEO Head-hunting for CFO Head-haunting for Controller Independent Quarterly Financial Analysis

OUTSOURCED CFO SERVICES

Lead Finance Function as business enabler. Strategic Planning. Design & Implement accounting system. KPI Design, measuring & monitoring. Profit planning, Product pricing & Cost optimization. Preparation of Financial Statement. Annual Budgets and Forecasting. Quarterly Financial and Budget Reviews. Balance Sheet Management. Inventory Management. Treasury and Cashflow Management. Strategic Tax Planning.

Lead Inorganic Growth Opportunities. Guide through Mergers and Acquisitions. Manage Capital Structure. Raise Capital for projects and initiatives. Investors Relation. Liaison with Regulators, Bank and Auditors. Yearly Business Valuations. Quarterly economic updates. Quarterly Industry Updates. Capacity building for finance team.

ACCOUNTING & TAX SERVICES

Preparation of Business Plans. New Company Registration. Installation of Accounting Systems. Budget Preparation. Account Receivables. Account Payables. Payroll Services.

GST & PST. Bank Reconciliation. Year End Tax Returns. Bookkeeping. Bank Letters. Financial Statement Preparations. Accounting Temp Staffing.

TRAINING

Modules

PEGS training - Keeping focus on mission-critical performance levers of Profitability, Efficiency, Growth & Sustainability. High level Analysis & Interpretation of Accounting Information for Decision Making – For Non-Financial Managers & Key Decision Makers. Forecasting, Budgeting & Performance Monitoring - A strategic tool for superior performance. Excel Modeling and Valuation. Canadian GAAP & IFRS training. Practical Bookkeeping. Software (Sage, QuickBooks, etc.)

For Whom?

Board Members. C-level executives. Accountants & Finance Professionals. Non-Financial Managers. Investment Managers. Entrepreneurs. Regulators. Investors. Analysts.